The digital revolution transformed different business sectors by the integration of the technologies with the individual business operations. The technologies have enhanced the several aspects of efficiency, speed, reliability, convenience, safety and accountability. The technologies applied in the Finance sector are termed as Fintech which specialize in core finance operations including accounting softwares, banking applications, Unified Payments Interface (UPI), UPI circle, Big Data, Artificial Intelligence (AI) and Machine Learning (ML) and many others. These Fintech applications have enriched the user experience, simplified the finance transactions in real time and in secure ways.

How to Activate UPI Circle?

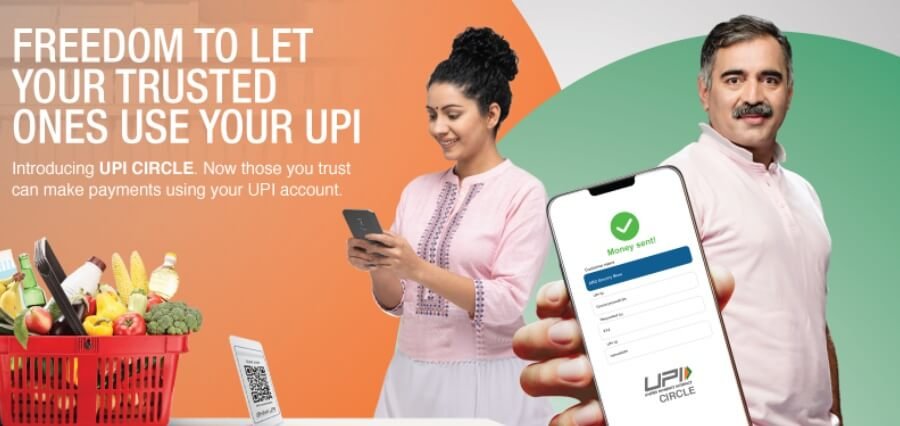

The digital banking transactions especially the UPI payments increased considerably post demonetization. These smart UPI payments enabled the users make quick payments from their bank accounts to merchants, individuals, bill payments or even transferring to bank accounts. The Unified Payments Interface (UPI) Circle, a delegated payment function, was established by the National Payments Corporation of India (NPCI) to improve digital payments and revolutionize digital payments in India. It makes it possible for a user’s dependents to use the UPI feature without need additional bank accounts. It seeks to encompass a greater segment of the populace that lacks access to a bank account. Let’s take a closer look at some of the key information on UPI Circle, including its functions, features, and associated factors.

Understanding the UPI Circle

With the introduction of UPI Circle, a new payment tool from the NPCI, two or more people can share a bank account to conduct UPI transactions.

This functionality enables several users to share a single UPI ID, enabling secure and delegated transactions between spouses, friends, and family members. Through UPI, users can conduct small-value transactions using the shared bank account.

The chief user is in charge of controlling access, establishing transaction limits, approving transactions, and other things. It makes it possible for secondary users to complete a transaction without having a bank account. The UPI circle is managed from the user’s smartphone, much as credit card uses, where the principal card holder can obtain an add-on card with particular and lower restrictions.

Features of UPI Circle:

A single platform that many people can share is provided by the UPI circle. The UPI Circle users’ transaction restrictions have been set by the NPCI body. The upper limitations are Rs. 15000 per month and Rs. 5000 per transaction.

The UPI Circle’s primary goal is to provide simple access to bank accounts for those without them who are physically challenged, elderly, adults, or children.

By merely scanning a QR code or entering a UPI contact, selecting a contact, and granting access to complete transactions, the person can be connected to the UPI circle. All apps provide this function free of charge to both primary and secondary users.

The highest authority in the UPI circle is held by the Primary users, who are the owners of bank accounts. The principal user initiates and oversees the transactions within the UPI circle. The principal user has complete control over adding, editing, modifying, imposing spending caps, granting partial or total access to the bank account, and even eliminating the secondary user or users.

The dependents, such as children, college students, and elderly people, who must pay for little purchases on their own or while they are away, are essentially the secondary users. Payments can be made by secondary users without the original user’s consent.

If there is only partial delegation, the secondary user can start the payment process, but they must first have the primary user’s consent, which requires a PIN. When full delegation is used, secondary users are free to make payments without the primary user’s consent or authorization.

Comprehending How UPI Circle Operates

Primary UPI users can designate a reliable person to handle payment transactions on their behalf by using UPI Circle. The secondary user’s authority will determine whether or not this payment is made in full. For people who are unable to handle their funds on their own, it is helpful.

Now let’s examine how UPI Circle functions in practice:

Stage 1: Using their preferred UPI app, the principal user starts a UPI Circle.

Step 2: The Circle gains a second user.

Step 3: The principal user grants the secondary user permissions and limitations.

Step 4: The secondary user accepts the invitation to join UPI Circle Step 5: After joining, the secondary user can utilize the UPI Circle to make UPI transactions

UPI transactions can begin as soon as the first user starts a UPI Circle and the secondary user accepts it. For the purpose of transferring funds, the primary user must create and share a UPI PIN with the secondary user.

The secondary user can take the actions listed below to send money via UPI Circle:

A: Scan the beneficiary’s QR code or input their UPI ID.

B: Type in the desired transfer amount.

C: Adding a remark to the transaction is an optional feature.

D: To complete the transaction, enter your UPI PIN (for secondary applicants with full delegation)

a notification is provided to the primary user via the UPI app when a secondary user with partial delegation starts a UPI transfer.

E: To eventually transfer the funds through the bank account, the principal user must input the UPI PIN (not in case of a secondary user with complete delegation)

Key elements of UPI Circle

To take advantage of this feature, users can choose any UPI app. Up to five auxiliary users can be added by a principal user. Only one primary user’s invitation can be accepted by a secondary user. From the outset, the principal member must fully or partially delegate to the secondary user. The same UPI constraints apply to both full and partial delegation. Transactions completed by a secondary user appear on both the bank statement and the UPI app. For every UPI transaction, there is an online dispute resolution (ODR) option.

Read More: Click Here