According to the median of 12 predictions published by Bloomberg News, the economy is on track to grow 10% in the fiscal year that began April 1.

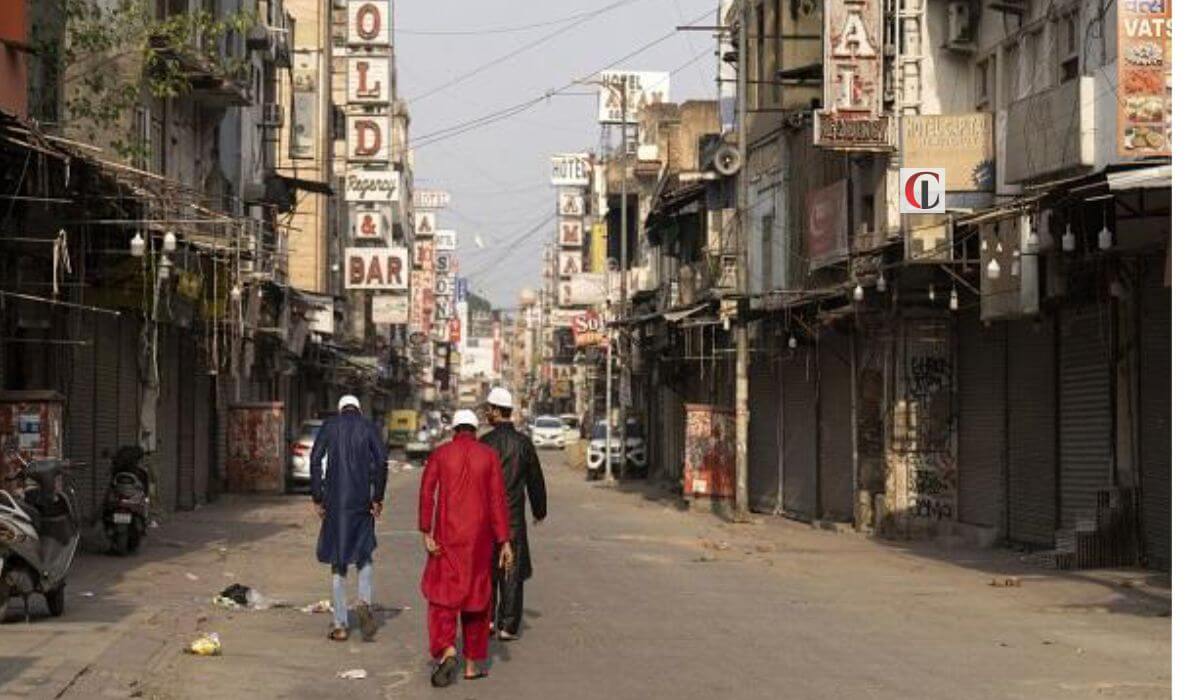

Even if virus instances have begun to fade and some sections of the country may reopen by June, given the economic uncertainty and unemployment at its highest level in a year, people are unlikely to spend freely.

The ability of the Indian economy to withstand a devastating outbreak of Covid-19 will be put to the test, while no one doubts its capacity to achieve the world’s fastest growth rate among major economies this year.

According to the median of 12 predictions published by Bloomberg News, the economy will increase 10% in the fiscal year that began April 1.

This comes after some analysts reduced their expectations in recent weeks to account for local activity constraints, such as in India’s political and commercial centres.

When Asia’s third-largest economy reopened last year following one of the toughest lockdowns in history, which lasted more than two months, it was pent-up desire for everything from mobile phones to cars that sparked consumption. Data due later Monday will almost certainly indicate that India’s gross domestic product increased by 1% in the three months ending March, marking the country’s second consecutive quarter of expansion since emerging from a rare recession.

The downgrades, on the other hand, are a warning not to take the economy’s recovery for granted. According to economists, the strength of the rebound will be determined by the ease of limitations across states, as well as consumers’ desire to spend, as they did last year when tight constraints were eased.

The Reserve Bank of India reported earlier this month that demand has taken the worst blow from the second wave of Covid infections, with a loss of mobility, discretionary expenditure, and employment. The central bank has kept monetary policy loose and injected cash into the economy to stimulate growth, and will review interest rates later this week.

“Even as India’s second Covid-19 wave begins to fade, the underlying economic toll now appears to be more than we expected,” said Rahul Bajoria, a Barclays economist. “Furthermore, India’s recovery is likely to be hampered by the slow pace of vaccinations and rolling lockdowns.”